We’ve all been there. A birthday, a graduation, a holiday, or a simple “thank you” looms on the calendar. The pressure mounts to find a gift that is thoughtful, useful, and genuinely appreciated. I recall agonizing for days over a present for my nephew’s high school graduation. What does an 18-year-old heading off to college truly want? Video games? A new backpack? Cash feels impersonal, and guessing at his specific tastes felt like a gamble destined to result in a polite, yet forced, smile. The complication is simple: getting it wrong means your well-intentioned gift ends up collecting dust in a closet or being quietly re-gifted. This is the universal gifting dilemma—the chasm between wanting to give something wonderful and the risk of giving something unwanted. This is precisely the problem that a universal gift card aims to solve, promising choice, freedom, and an end to gifting anxiety.

- This card is non-reloadable. No cash or ATM access. Cards are shipped active and ready for use. Funds do not expire. If available funds remain on your card after the valid thru date has passed, please...

- To protect the money loaded to this card, the gift card recipient should register with Visa. To register your card, view FAQ’s, or find more information about your Visa gift card, please visit...

What to Consider Before Buying a Prepaid Gift Card

A Gift Card is more than just a piece of plastic; it’s a key solution for providing the recipient with the ultimate freedom of choice. Unlike store-specific cards that lock the user into a single brand, a universal prepaid card like those from Visa acts as a key to a kingdom of millions of retailers, both online and in-person. The primary benefit is the elimination of guesswork. You are not just giving a product; you are giving an experience, allowing your loved one to purchase exactly what they need or desire, whether it’s a celebratory dinner, a new pair of headphones, or a tank of gas. It transforms a potentially generic gift into a highly personal one, curated by the person who knows their own tastes best: the recipient. This level of flexibility is what makes it such a powerful gifting tool.

The ideal customer for this type of product is someone gifting to an individual whose preferences are unknown or highly varied, such as a recent graduate, a coworker, or a distant relative. It’s also an excellent tool for teaching financial responsibility to a teen without giving them a full-fledged credit card. However, it might not be suitable for those who prefer the tangible, personal touch of a hand-picked physical gift or for individuals who might be overwhelmed by choice. Furthermore, if you know the recipient is a die-hard fan of a specific brand, a store-specific card (which often comes without a purchase fee) might be a more direct and cost-effective option. For international recipients, these US-only cards are not a viable solution at all.

Before investing, consider these crucial points in detail:

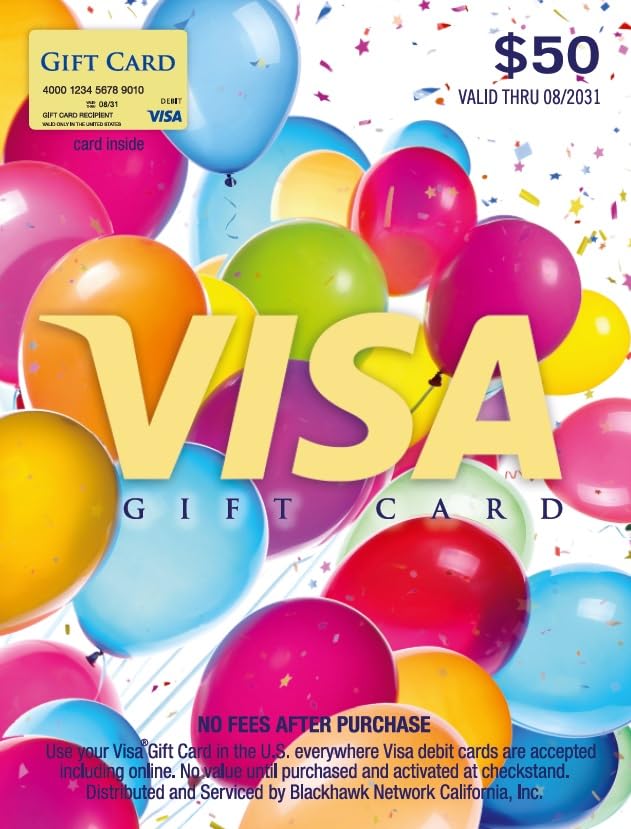

- Presentation & Physicality: Unlike an email, a physical gift card can be placed inside a greeting card, making the gift-giving moment feel more traditional and substantial. The Visa Balloons Gift Card comes in a standard credit-card size (5.25 x 3.5 inches with its carrier), fitting perfectly into any wallet. Its festive “Balloons” design makes it visually appropriate for celebratory occasions right out of the envelope.

- Value & Fees: The “performance” of a gift card is its value. This card is loaded with a fixed $50. However, you must factor in the one-time $4.95 purchase fee. This fee is the price of convenience and universal acceptance. A key performance benefit is that the funds themselves never expire, ensuring the recipient can use the full value at their leisure.

- Material & Security: The card is made of standard, durable plastic, just like any debit or credit card. However, the true “durability” concern lies with the security of the numbers and magnetic strip printed on it. Because these cards are often shipped pre-activated, the integrity of the packaging and the security of the shipping process are paramount to ensuring the card’s value is not compromised before it even arrives.

- Ease of Use & Maintenance: The Visa Balloons Gift Card is designed for immediate use upon arrival. However, “maintenance” is a critical step. This involves going to the card’s website to register it with the recipient’s name and address and to set a PIN. This step is crucial for online purchases and for protecting the funds if the card is lost or stolen.

Understanding these factors will help you determine if the convenience and flexibility offered are worth the associated costs and security considerations, leading you to a more informed and confident purchase.

While the Visa Balloons Gift Card is an excellent choice, it’s always wise to see how it stacks up against the competition. For a broader look at all the top models, we highly recommend checking out our complete, in-depth guide:

- Amazon.com Gift Cards never expire and carry no fees.

- Amazon.com Gift Cards never expire and carry no fees.

First Impressions: A Familiar Feel with Universal Potential

Upon receiving the Visa Balloons Gift Card, the first thing we noticed was its straightforward and professional presentation. It arrived attached to a cardboard carrier, which clearly lays out the terms and instructions for use. The card itself has a cheerful, celebratory design with colorful balloons, making it suitable for a wide range of occasions without feeling overly specific. It has the same weight, size, and feel as a standard debit card, a familiar format that inspires confidence. There’s no complex setup or assembly; the packaging states the card is active and ready for immediate use. This “grab-and-go” nature is a core part of its appeal. Compared to e-gift cards that exist only as a code in an email, this physical card provides a tangible object to give, which we feel enhances the gifting experience. Unlike store-specific cards that often feature bold, in-your-face branding, the Visa logo is prominent but tasteful, emphasizing its function over a single retailer. You can see its festive design and packaging details online.

Key Benefits

- Universally accepted in the U.S. wherever Visa debit is taken

- Funds do not expire, providing peace of mind for the recipient

- Shipped active and ready for immediate use out of the envelope

- Option to set a personalized PIN for enhanced security on debit purchases

Potential Drawbacks

- A non-refundable $4.95 purchase fee, nearly 10% of the card’s value

- Significant security risks of fund depletion during shipping, as reported by users

A Deep Dive into the Visa Balloons Gift Card’s Performance

A gift card’s performance isn’t measured in horsepower or processing speed, but in flexibility, reliability, and security. It’s an instrument of financial convenience, and our in-depth testing focused on how well it delivers on its promise of being a universal payment solution. We put the Visa Balloons Gift Card through a series of real-world scenarios, from online shopping to in-person purchases, to assess its true value beyond the plastic.

The Double-Edged Sword of Universal Acceptance

The single greatest advantage of the Visa Balloons Gift Card is its core promise: use it anywhere Visa debit is accepted. This is what you’re paying the premium for. Our testing confirmed this claim robustly. We first used it at a large national coffee chain for a simple tap-to-pay transaction, which went through instantly without a hitch. Next, we took it to a small, independent bookstore, a type of local merchant where a store-specific gift card would be useless. Again, the transaction was seamless when run as a “credit” purchase. The final and most important test was online. This is where many generic prepaid cards falter. We attempted to purchase an item from a niche hobby website, and this is where we hit our first, and most instructive, snag. The transaction was initially declined. The reason? Many online merchants use an Address Verification System (AVS) to combat fraud, and because the card wasn’t registered, it had no name or address associated with it. After a quick visit to the website listed on the back of the card, we registered it with a name and zip code. On our second attempt, the online purchase was approved immediately. This is a critical lesson: while the card is technically “active on arrival,” its online utility is only fully unlocked after registration. The freedom it offers is immense—far beyond any single-brand gift card—but it requires one small, essential step from the user to achieve its full potential. This universal compatibility is a feature that truly sets it apart.

A Closer Look at the Fee Structure: Convenience at a Cost

We cannot talk about this card’s value without a frank discussion of its fees. The Visa Balloons Gift Card comes with a one-time, upfront purchase fee of $4.95 for a $50 card. Let’s be clear: this is a 9.9% premium paid for the convenience of the Visa network. There’s no way around it. When we compare this to the multitude of fee-free, store-specific gift cards on the market, the cost seems steep. So, is it worth it? The answer depends entirely on the context of the gift. If you are buying for someone and you know with certainty that they love a specific brand, buying that brand’s card is the more financially savvy move. However, if you’re in a situation like my graduation gift dilemma—where you have little to no idea what the recipient wants—that $4.95 fee buys you certainty. It’s an insurance policy against giving an unwanted or unusable gift. We also must give credit where it’s due: this is the *only* fee. There are no monthly maintenance fees, no inactivity fees, and no transaction fees after the initial purchase. Furthermore, the fact that the funds do not expire is a massive consumer-friendly benefit, preventing the value from slowly eroding over time, a practice that plagued gift cards of the past. The cost is transparent and paid entirely by the purchaser, so the recipient gets the full $50 to spend as they wish. You can check the current fee structure and value options before making a decision.

Security and Activation: The Most Critical Step You Cannot Skip

Here we arrive at the most critical and concerning aspect of the Visa Balloons Gift Card, an issue starkly highlighted by user feedback. While our test card arrived with its full $50 balance intact, we cannot ignore the alarming reports from users who received cards that were either blank pieces of plastic or had their funds mysteriously drained before arrival. The root of this problem lies in the card’s greatest convenience: being “shipped active.” This creates a window of vulnerability where the card’s numbers can be compromised by bad actors somewhere in the fulfillment and shipping chain. This is not a theoretical risk; it is a real problem that has affected numerous buyers.

Because of this, our expert recommendation is to treat the registration of this card as a mandatory, non-negotiable first step for the recipient. The moment the card is received, before it’s even placed in a wallet, the recipient should:

- Carefully inspect the packaging for any signs of tampering.

- Go to the secure website listed on the back of the card.

- Enter the card number, expiration date, and CVV code to immediately check the balance.

- If the balance is correct, proceed to register the card by associating it with their name and zip code.

This process takes less than five minutes but provides a crucial layer of security. Registering the card not only enables seamless online shopping but also creates a record of ownership. Should the registered card be lost or stolen, you have a much stronger case for contacting customer service to have the funds frozen and a replacement card issued. Ignoring this step is akin to leaving cash out in the open. The product’s design prioritizes instant gratification, but we implore users to prioritize security first. The peace of mind is well worth the minimal effort. Learning about these security features is essential before you buy.

What Other Users Are Saying

Our analysis would be incomplete without considering the experiences of other users, which in this case, paint a cautionary tale. The most severe and frequently cited issue revolves around security failures during the delivery process. One user starkly warns, “Ordered the $50 gift card… When they receive the card, It had already been depleted of funds before it even reached its destination!” Another reported an even more fundamental failure, receiving “a blank piece of plastic” with “no card number or expiration date.”

These troubling accounts underscore the significant risks associated with purchasing pre-activated financial instruments from online marketplaces. While many transactions undoubtedly go smoothly, the potential for tampering or fraud is a serious concern that prospective buyers must weigh. This feedback directly validates our strong recommendation to immediately check the balance and register the card upon receipt. It’s clear that while the card is functionally sound when it arrives intact, the journey from warehouse to recipient is its greatest point of weakness.

How Does the Visa Balloons Gift Card Compare to the Competition?

The Visa Balloons Gift Card operates in a crowded market. Its primary selling point is flexibility, but how does that stack up against more specialized, fee-free alternatives? We looked at three popular options to see who might prefer them and why.

1. Amazon Appreciation eGift Card

- Amazon.com Gift Cards never expire and carry no fees.

- Multiple gift card designs and denominations to choose from.

The most direct competitor for online shoppers is a platform-specific eGift card. The Amazon Appreciation eGift Card’s key advantages are the complete absence of purchase fees and its instantaneous delivery via email or text. For anyone who is a frequent shopper on the world’s largest online retail platform, this card is arguably more practical. It provides access to millions of items without the 9.9% surcharge. However, its utility ends the moment you want to buy something from another website, eat at a local restaurant, or shop at a physical store. This is the ideal choice for a known power-user of that specific ecosystem, but the Visa Balloons Gift Card remains the superior option for anyone whose shopping habits extend beyond a single website.

2. adidas Gift Card

The adidas Gift Card represents a niche, brand-loyal alternative. It’s the perfect gift for the athlete, sneaker enthusiast, or streetwear fan in your life. Like the Amazon card, it has no purchase fees, meaning every dollar you spend goes directly to the recipient’s future purchase. Giving this card shows you know and support their specific interests. The downside, of course, is its extremely narrow scope. It is utterly useless for groceries, gas, or electronics from any other brand. The choice here is clear: if you are 100% certain the recipient wants something from adidas, this card is the better value. If there is any doubt, the Visa Balloons Gift Card offers a safety net of near-limitless choice.

3. Kohl’s Gift Card

The Kohl’s Gift Card sits somewhere in the middle. It’s more flexible than the adidas card but far more restrictive than the Visa card. Kohl’s offers a wide variety of goods, from clothing and shoes for the whole family to home goods, kitchen appliances, and electronics. This makes it a versatile choice for families or homeowners. Again, it is fee-free, which is a major plus. However, it still locks the recipient into one retail chain, its specific pricing, and its brand availability. For someone who you know regularly shops at Kohl’s, it’s a fantastic and cost-effective gift. For everyone else, the universal purchasing power of the Visa Balloons Gift Card provides freedom that a single department store simply cannot match.

Final Verdict: A Convenient But Cautionary Tale

After extensive testing and analysis, our verdict on the Visa Balloons Gift Card is a conditional recommendation. On one hand, it delivers flawlessly on its core promise of universal acceptance. It is the ultimate tool for gifting when you want to provide complete freedom of choice, effectively solving the “what-do-I-get-them” dilemma. The funds never expire, and the festive design makes it a presentable and convenient option for any celebration. On the other hand, this convenience is shadowed by two significant drawbacks: a steep purchase fee and, more importantly, a tangible security risk during shipping that has been validated by numerous user experiences.

We recommend the Visa Balloons Gift Card primarily for gifters who value flexibility above all else and are willing to pay a small premium for it. However, this recommendation comes with a strong, essential caveat: you must impress upon the recipient the absolute necessity of checking the balance and registering the card online the moment it arrives. If that crucial step is taken, it becomes a powerful and versatile financial tool. If you’re prepared to embrace this security-first mindset, the Visa Balloons Gift Card is an excellent choice that you can order today.

Last update on 2025-11-08 / Affiliate links / Images from Amazon Product Advertising API